Why Is A Business Plan Important?

Starting a business without a plan is akin to embarking on an arduous journey without a map or compass. Here are the key ways a business plan will help your company launch and thrive.

The research and analysis it takes to write a business plan significantly contribute to the strategic planning process and serve several crucial functions that are essential for the business’s longevity.

Communication Tool: A business plan communicates a new business’s value proposition, clarifies objectives, and articulates the strategies to constituents both within and outside of the company.

Planning: It demands that business owners and leaders meticulously plan and address details such as budgeting, market analysis, competitive landscape, sales strategies, target demographics, organizational structure, and operational logistics.

Risk Management: Business plans help identify and assess potential risks and what mitigation strategies will be employed to navigate those risks. By foreseeing potential hurdles, businesses can proactively strategize solutions, which is crucial for resilience in a competitive marketplace.

Attract Financing: Investors and lenders often require a comprehensive business plan before committing capital to a venture. The document must demonstrate a thoughtful, realistic path toward profitability.

Resource Allocation: By outlining key business activities and projected outcomes, a business plan helps ensure resources are allocated effectively, which is critical in the early stages where funds might be limited.

Performance Measurement: Having clearly stated goals and strategies in the business plan allows for ongoing performance measurement. This enables companies to track progress, make necessary adjustments, and stay aligned with long-term objectives.

Feasibility Analysis: Perhaps most importantly, the process of creating a business plan forces entrepreneurs to rigorously examine the feasibility of their business idea. If the process reveals fundamental issues, it can save individuals from investing time and resources into a venture that’s likely to fail.

Sets Clear Business Objectives

The business plan compels the entrepreneur to think deeply about what they aim to achieve. Objectives within a business plan are often SMART: Specific, Measurable, Achievable, Relevant, and Timely. This clarity enables the business owner and any potential investors or partners to understand what the business stands for and what it will strive to accomplish with every decision.

Assists With Decision-Making

The core purpose of a business plan also extends to assisting stakeholders in making informed decisions. Whether it is the entrepreneur, investor, or manager, having a business plan provides a factual foundation for choices that need to be made and reduces the risk associated with business operations.

A Guide for Internal Decision-Making

A plan lays out different scenarios and prepares internal stakeholders to craft strategies to navigate them effectively. For the management team, this might involve decisions regarding hiring practices, product development paths, or funding strategies.

A Framework for External Decision-Making

For external stakeholders such as investors or lenders, the business plan provides a clear picture of how their money will be used, what the risks are, and what the potential returns might be.

Facilitates Communication With All Stakeholders

A business plan is designed to be a formal document that informs and persuades, often functioning as a communication tool to present the business’s vision, strategy, and goals to various audiences.

Tool for Engaging Investors

For aspiring entrepreneurs seeking capital, the business plan is the primary mode of articulating the business opportunity to potential investors. It needs to be able to capture the essence of the business and excite the reader about its potential. The plan provides investors with an understanding of how the business will generate returns and what the exit strategy might be, thus aiding them in their decision to invest.

Means of Aligning Team Members

A business plan is also used internally to align the team members with the business’s strategic objectives. It ensures that everyone from the top-level management to new hires understands the company’s direction, priorities, and what is expected of them.

There are several common sections found in most business plans, including executive summary, company description, market analysis, organization and management, product or service description, marketing and sales strategies, funding request, financial projections and an appendix. For an in-depth outline of what information you’ll want to have in each section, read our Elements of a Business Plan breakdown.

Attracts Investors and Secures Financing

A persuasive business plan shows growth, stability, and potential ROI (return on investment).

Investors will closely review the market analysis, operational strategies, financial projections, and management team profiles laid out in the plan. A structured and realistic business plan will give them assurance about your company and leadership and reduce their perceived risk.

Financial institutions like banks and SBA lenders require a detailed business plan to approve loans. For them, it’s evidence that grants insight into how the borrowed funds are to be utilized and repaid, including any collateral on offer to secure the loan.

Guides Growth and Development

A business plan encompasses the vision and future direction of the company, allowing for goal setting and strategic planning. It helps to identify key milestones, which is crucial for benchmarking and measuring progress.

Strategic growth plans incorporated within the overall business plan can also assure stakeholders of the company’s serious intent and roadmap to success. These could be crucial in demonstrating the business’s long-term feasibility, which is often a concern for investors. In addition, a dynamic business plan enables you to pivot when necessary.

Helps Identify Potential Challenges

A meticulously crafted business plan acts as an early warning system. It helps identify potential pitfalls and hurdles that might obstruct the path to business growth and profitability. By recognizing these challenges in advance, you can develop contingency plans to mitigate risks, ensuring a more robust, resilient business model. Explore the “what-ifs” and to craft strategies that address potential problems such as changes in buyer behavior, entry of new competitors, supplier issues, or regulatory alterations.

Creates Accountability and Tracking

A business plan doubles as an accountability chart for individuals within the organization. By delineating clear goals, responsibilities, and deadlines, it creates a culture of accountability and heightens the focus on performance and results.

Financial forecasts, marketing strategies, and operational plans all create benchmarks for tracking actual performance. This comparative analysis between actual and projected figures enables business owners to see whether the business is going in the right direction, and helps to track return on investment (ROI) for marketing campaigns, and operational efficiencies, and can even extend into cost-benefit analyses of business expansions or product launches.

Aids in Strategic Planning

By articulating strategies for differentiation, market penetration, and resource allocation, a business plan ensures that efforts are efficiently directed toward achieving desired outcomes. It mandates an alignment of short-term actions with the broader vision, avoiding getting distracted by opportunities that don’t serve the company’s objectives.

A business plan fosters an informed culture within an organization. People are able to see how their part fits into the greater scheme. Informed employees are more likely to buy into the process and are more likely to make decisions that align with the company’s strategic objectives, propelling the business forward.

Propels Research and Data Collection

Creating a business plan is a process grounded in deep research and data collection. Research should involve both primary data—gathered first-hand, such as surveys, questionnaires, and interviews with potential customers—and secondary data, which include industry reports, statistical databases, and competitor insights.

Why is research and data collection important? Because it reduces risk. By understanding market conditions, customer needs, and competitive landscapes, entrepreneurs can make informed decisions rather than relying on guesswork. This research phase needs to answer key questions, such as:

- What is the current state of the industry?

- Who are the key competitors and what are their strengths and weaknesses?

- What trends are shaping the market, and what gaps exist?

- How large is the potential market for the product or service?

The U.S. Small Business Administration (SBA) offers industry guides, market research, and competitive analysis resources—a goldmine of data for new entrepreneurs. Likewise, using tools like SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) helps examine internal and external factors that will influence the business’s chances of success.

The research phase also should involve internal data collection. It assesses the company’s resources, including personnel qualifications, financial resources, and operational capabilities, to ensure alignment with proposed business objectives.

Defines Target Audience and Market

Understanding of who the customers are, their behaviors, preferences, needs, and the ways they engage with brands and products will help you tailor your product development, marketing strategies, and overall business approach to better meet their needs.

In this step, demographic, psychographic, and behavioral data are key in painting a vivid picture of the target audience. You’re looking to delineate aspects such as:

- Age, gender, income level, education, and location of your ideal customers.

- Lifestyle, values, interests, and attitudes that influence their purchasing decisions.

- The channels through which the target audience prefers to receive information and make purchases.

Why is the target audience important in a business plan? Because specificity sells. For example, a Harvard Business Review article emphasized personalized customer service as a decisive factor in customer retention and satisfaction.

Sets Realistic Goals and Objectives

This is all about translating the grand vision into achievable, measurable, and time-bound milestones.

Realistic goals and objectives take into account the insights gathered from research and the defined target audience. They are SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. For example, an objective could be to achieve a certain percentage of market share within a specific period or to reach a certain number of recurring customers by a given quarter.

A study published in the Journal of Management showed that setting specific and challenging goals led to higher performance 90% of the time. Additionally, goals enable alignment across the organization, ensuring that every team member understands their role in achieving the company’s objectives. A business plan without clear objectives is like a ship without a rudder—unlikely to reach its intended destination.

Details Marketing and Sales Plans

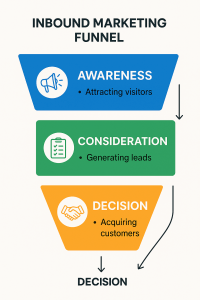

It’s paramount to explain which marketing channels will be utilized (such as social media, email marketing, SEO), the type of sales tactics (direct sales, inbound marketing), and the sales funnel that will guide prospects from awareness to purchase.

Key questions to explore include:

- How will the product or service be positioned in the market?

- What is the branding strategy?

- What are the key messages and value propositions that will resonate with the target audience?

- How will marketing effectiveness be tracked and measured?

A business plan that includes detailed, evidence-based marketing and sales strategies is likely to be more attractive to investors and more effective in the marketplace. For example, according to HubSpot, inbound marketing strategies (attracting customers by offering them relevant and valuable content) generate 54% more leads than traditional paid marketing.

Outlines Financial Projections

Financial forecasting helps entrepreneurs, as well as potential investors, understand the financial viability of the business. Projections should be realistic and based on the data collected in the research phase, market trends, and industry benchmarks.

Key components of the financial projections include:

- Startup costs breakdown.

- Sales forecast.

- Profit and loss statement forecast.

- Cash flow forecast.

- Break-even analysis.

According to a U.S. Bank study, 82% of businesses fail due to cash flow problems. Financial planning can help anticipate cash needs, manage budgets, and avert financial shortfalls before they become critical.

Sets Performance Metrics and Benchmarks

Clear performance metrics establish what success looks like for a company, breaking it down in terms of sales figures, market share, customer acquisition costs, profit margins, and other relevant financial and operational indicators. Effective metrics serve as a litmus test for the health and progression of the business, allowing managers to ascertain whether they are on track to meet the goals laid out in the business plan.

Benchmarking involves comparing a company’s performance against industry standards or the performance of leading competitors. This comparison can be enlightening, offering insights into areas where a business is excelling or underperforming. A business plan laden with benchmark data clarifies competitive positioning and can instruct strategic adjustments.

Guides Adaptations in Changing Business Environment

In today’s fast-paced business world, adaptability and flexibility are not merely advantageous—they’re requisite for survival and growth.

Adaptation goes beyond mere survival. It is about seizing new opportunities that arise due to shifts in the business environment. A business plan that is regularly revisited and modified can highlight new avenues for growth, whether through product diversification, market expansion, strategic alliances, or other innovative endeavors.

In the event of economic downturns or unforeseen disruptive events – such as the COVID-19 pandemic – a business plan becomes crucial in crisis management and the continuity of operations. By having contingency plans and resource allocation strategies in place, a business can quickly pivot and ensure resilience.

Frequently Asked Questions:

How does a business plan help with securing investment and funding?

What are the benefits of regularly updating a business plan?

How can a business plan help in identifying potential challenges before they occur?

What type of business plan is suitable for a small startup?

Can a business plan really impact the growth and development of a company?

How detailed should the financial projections in a business plan be?

In what ways does a business plan facilitate communication with stakeholders?

How often should a business plan be reviewed and revised?

Is it necessary to include an appendix in a business plan, and what should it contain?

Why is market analysis important in a business plan?

What role does risk analysis play in the business planning process?

The research and analysis it takes to write a business plan significantly contribute to the strategic planning process and serve several crucial functions that are essential for the business’s longevity.

Communication Tool: A business plan communicates a new business’s value proposition, clarifies objectives, and articulates the strategies to constituents both within and outside of the company.

Planning: It demands that business owners and leaders meticulously plan and address details such as budgeting, market analysis, competitive landscape, sales strategies, target demographics, organizational structure, and operational logistics.