What Are The Most Common Business Plan Writing Mistakes?

What Are the Most Common Business Plan Writing Mistakes? Avoid these planning pitfalls.

Aside from the biggest mistake of all — not having a plan at all — there are some common missteps that can trip up entrepreneurs as they begin their journeys.

Grammatical errors: Frequent grammar mistakes can distract readers from the content of your business plan. Utilize grammar-checking tools and have a proficient editor go through the text.

Spelling mistakes: Incorrect spelling, especially of proprietary terms or industry-specific language, can undermine credibility.

Inconsistent formatting: Headings, bullet points, font sizes, and styles should be uniform throughout the document.

Incomplete sections: Ensure that all sections of the business plan, particularly the financial appendix, are complete and include all necessary documents and appendices.

Outdated references: Cross-reference all data, ensuring all market statistics, references, and citations are current and relevant.

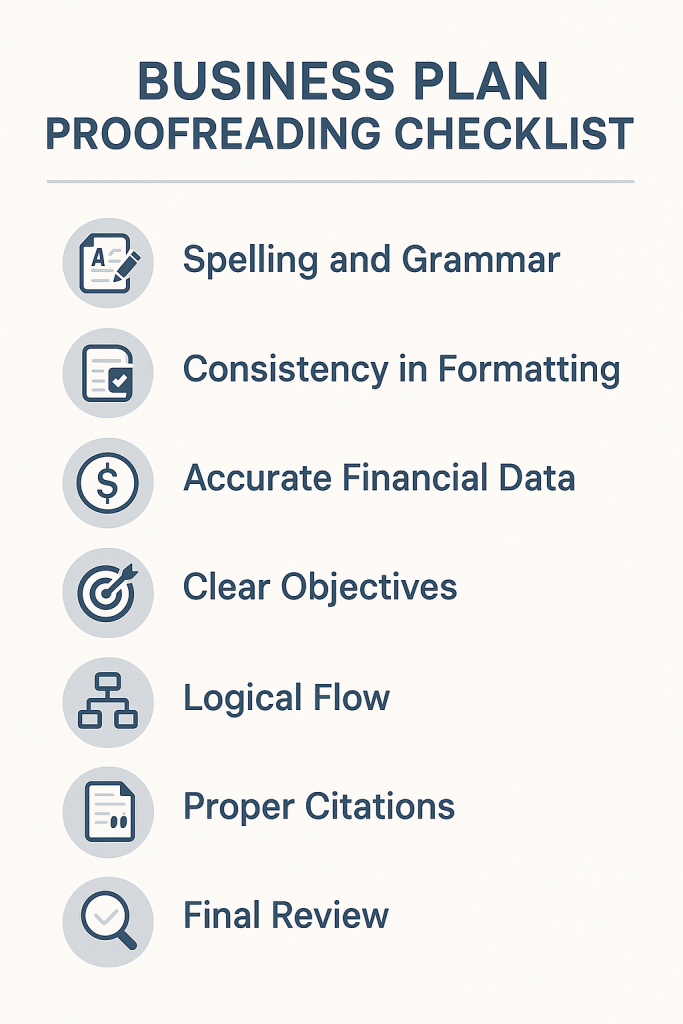

Crucial Areas for Proofreading in a Business Plan

While you want your plan to be as mistake-free as possible, these are areas that readers typically will be focusing on.

Executive Summary: As the window into your business plan, ensure that the executive summary is free from typographical and grammatical mistakes. It should concisely encapsulate your vision, mission, product offerings, market potential, unique value proposition, and financial highlights.

Market Analysis: Check for accuracy in the representation of market data and sources. Ensure that there are no contradictions within the text and that all figures quoted, like market size and share, are current and correctly cited.

Financial Projections: Scrutinize the financial section for errors in calculations, assumptions, and projections. Misstated financials can be severely damaging. Ensure that the balance sheet, income statement, cash flow projections, and break-even analysis are free of errors and easy to understand.

Product Descriptions: Verify that descriptions of products or services are consistent throughout the document. Technical specifications, features, and benefits should be thoroughly checked for accuracy.

Management Profiles: The bios of the management team should be current, without overstating qualifications or experience. Each profile should reflect the individual’s role and relevance to the success of the business.

Other Common Mistakes and How to Avoid Them

Overambitious Financial Projections

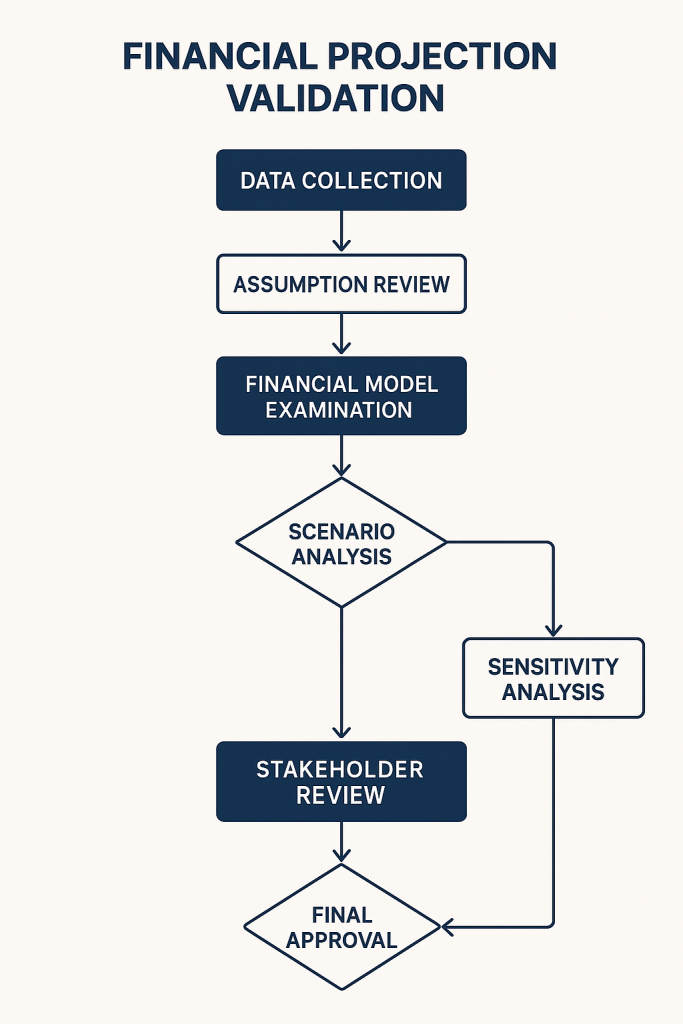

Entrepreneurs often fall into the trap of projecting high revenues and underestimated expenses in their enthusiasm to paint an impressive picture of the future. These projections are often referred to as ‘hockey stick’ forecasts, where exponential growth is expected right from the start.

To avoid this mistake, demonstrate a clear understanding of industry benchmarks and reasonable growth rates. Utilize market research, and historical data from similar businesses, and clearly state the assumptions your projections are based on. Be conservative with your figures and be prepared to justify them. Include best-case, moderate-case, and worst-case scenarios.

It’s also critical to plan for contingencies. Reality often includes unexpected hurdles that can affect financial performance. Make sure your projections consider potential risks and that you have plans in place to mitigate them. A solid financial model should be able to withstand scrutiny and reflect both the entrepreneur’s optimism and the necessary prudence to persuade investors or lenders of the plan’s credibility.

Neglecting the Competition

A thorough business plan must include a comprehensive analysis of competitors, demonstrating that there is a deep understanding of the market landscape. Often, entrepreneurs either overlook the competition or dismiss it too quickly without proper acknowledgment of their strengths and the threats they pose.

To avoid this misstep, conduct a detailed competitive analysis. Identify direct and indirect competitors and evaluate their product offerings, market share, strengths, and weaknesses. Detail how your business differentiates itself from these competitors, focusing on unique selling points (USPs), competitive pricing, better service, or innovative features. Understanding the competitive landscape will not only strengthen your business plan but also help to strategize how to effectively enter the market and secure a competitive advantage.

| Criteria | Your Company | Competitor A | Competitor B | Competitor C |

|---|---|---|---|---|

| Product Quality | Rate 1-5 | Rate 1-5 | Rate 1-5 | Rate 1-5 |

| Pricing Strategy | Describe approach | Describe approach | Describe approach | Describe approach |

| Market Share | % or estimate | % or estimate | % or estimate | % or estimate |

| Unique Features | List key features | List key features | List key features | List key features |

| Customer Service | Rate 1-5 | Rate 1-5 | Rate 1-5 | Rate 1-5 |

| Distribution Channels | List channels | List channels | List channels | List channels |

| Marketing Budget | Estimate if known | Estimate if known | Estimate if known | Estimate if known |

| Strengths | List 2-3 | List 2-3 | List 2-3 | List 2-3 |

| Weaknesses | List 2-3 | List 2-3 | List 2-3 | List 2-3 |

Ignoring Market Analysis

Market analysis is crucial for understanding the target audience, determining market need, and gauging the potential for market growth. Entrepreneurs often ignore it either because of a lack of understanding of its importance or due to insufficient research. A business plan without a strong market analysis appears unvalidated and is unlikely to convince stakeholders of its viability.

Be sure to conduct a deep dive into the market you’re looking to enter. Identify demographics, market size, growth potential, and trends. Analyze customer pain points and preferences to ensure your product or service aligns with demand. A data-driven approach will make your business plan far stronger and show stakeholders that there is a tangible market need for what you’re offering.

Underestimating Costs

This can lead to significant cash flow problems, which is one of the leading causes of small business failure. A strong business plan accounts for all expenses – including hidden and unexpected costs – to provide a realistic view of the company’s financial future.

Avoid this risk by meticulously listing all startup costs, ongoing operational expenses, and potential unexpected costs, such as emergency repairs or economic downturns. Consult with industry experts and accountants to ensure that your cost estimates are comprehensive and realistic. Also, plan for a financial cushion or reserve budget to absorb unforeseen expenses so your business can navigate challenges without compromising its financial stability.

Vague or Undefined Goals

An effective business plan must articulate clear, measurable, and achievable goals. Vague or undefined goals can render a plan directionless and unusable as a tool for measuring progress and performance. Goals should be specific, giving a clear indication of what the business intends to achieve in the short-term and long-term.

The SMART criteria (Specific, Measurable, Achievable, Relevant, and Time-bound) serve as a useful framework for setting strategic goals. For example, rather than stating a goal to “increase sales,” a SMART objective would be to “increase sales of product X by 30% in the next fiscal year through targeted online marketing campaigns.”

Well-defined goals provide focus for a business, guiding strategies and resource allocation. They also allow for benchmarking and course corrections as the business evolves. Goals lacking specificity or realism could lead to misaligned expectations among stakeholders and an inability to execute strategies effectively.

Neglecting Risk Analysis

A critical element of business planning that is often neglected is risk analysis. Ignoring potential risks leaves a business vulnerable and without preparation for the inevitable challenges of the market. Every business plan should contain a risk analysis section, highlighting possible risks and detailing mitigation strategies.

Including a risk analysis demonstrates to investors and stakeholders that the entrepreneur is not only optimistic but also pragmatic and prepared for contingencies. Risks can range from market fluctuations, supply chain disruptions, technological changes, to regulatory alterations, each with the potential to impact operations significantly.

Entrepreneurs must think through various scenarios and devise response strategies. For instance, if a new regulation could impact production processes, the plan should discuss proactive compliance measures. If dependency on certain suppliers poses a risk, a plan B involving alternative sources can alleviate concerns.

Revising Your Plan Based on Feedback

After thorough proofreading, the next critical step is to receive feedback. Input from others can shed light on areas of the business plan that may be unclear, lacking in substance, or may simply benefit from an outside perspective. Feedback should be sought from trusted colleagues, mentors, industry experts, or even potential customers.

Types of Feedback and Their Benefits

Constructive criticism: Objective criticism can help identify weaknesses in the business plan. Be open to comments regarding the feasibility of your goals and strategies, as misunderstands may indicate the need for clearer communication.

Market and industry insights: Industry professionals can offer valuable insights into market trends and competitive strategies that could strengthen your business plan.

Financial scrutiny: Accountants or financial advisors can provide a critical evaluation of the financial projections and assumptions. A second set of eyes on financial data can help uncover any unrealistic projections or overlooked expenses.

Format and presentation: Graphic designers or marketers may provide feedback on the visual appeal of the business plan and whether it aligns with branding strategies.

Utilizing Feedback to Strengthen the Business Plan

Integrating feedback and revising the business plan is a delicate balance between retaining the original strategy and being adaptable to new insights. Maintain an objective tone and resist the urge to become defensive about your business strategy when considering feedback. Each critique presents an opportunity for improvement.

Strategies for Effective Revisions

Prioritize changes: Changes should be prioritized based on their impact on the goals and objectives of the business plan. Fundamental issues should be addressed before making minor edits.

Document all changes: For transparency and future reference, keep a record of the changes made to the initial version of the business plan.

Verify consistency: After making revisions, ensure that changes are reflected throughout the document to maintain consistency, especially in sections that interrelate, such as the market analysis and marketing strategy.

Final Reviews and Approvals

Before finalizing the business plan, conduct a last review to ensure all sections align seamlessly and that the document as a whole presents a clear, well-supported vision for the business. This review should confirm that the plan is pragmatic, financially reasonable, and presents an attainable strategy for success.

These are the key areas to focus on during the final review:

Alignment of objectives and strategies: Confirm that all goals outlined in the executive summary and throughout the document are supported by the strategies detailed in subsequent sections.

Financial accuracy and clarity: Validate that all financial projections, funding requests, and investment details are accurate, clear, and realistically aligned with industry standards.

Market readiness and risk assessment: Ensure that they reflect current conditions and that mitigation plans are robust.

Polished presentation: Check the business plan for a polished, professional appearance. Attention to detail in terms of design, formatting, and overall presentation can influence the perception of your business’s potential.

Confirmation of legal compliances: Ensure that your business plan adheres to all legal requirements, respects intellectual property rights, and includes any disclaimers or confidentiality agreements necessary.

Once the final review is complete and the necessary adjustments are made, the business plan is ready for presentation to potential investors, partners, lenders, and stakeholders. The plan should reflect a comprehensive and cohesive picture of the business, with all elements working together to show its future potential.

Resources to Help Write Your Business Plan

There are many resources available to entrepreneurs to ensure a professional end product.

Business Plan Software

Business plan software can play a crucial role in streamlining the process of crafting a comprehensive business plan. One of the core benefits of business plan software is its capacity to give structure and guidance throughout the planning process. With built-in templates, financial calculators, and step-by-step wizards, the software provides a user-friendly approach to a potentially overwhelming task.

The market offers a diverse selection of business plan software tailored to various business needs. Critical evaluation points when selecting a software package include ease of use, range of features, customization options, and after-sale support.

For example, software like Bplans are widely recognized for their robust tools and user interface that enable entrepreneurs to create detailed and investor-ready business plans.

One of the significant benefits of business plan software is that it helps in creating financial projections—an often complex and error-prone part of plan preparation. Applications such as Bplans come with built-in algorithms that execute complex calculations, ensuring financial data is both accurate and presentable.

Some software offers collaborative features, which enable multiple team members to contribute and edit various parts of the business plan simultaneously. They often include access to market data to help in the competition and market analysis sections, ensuring that business owners are making informed decisions based on current trends and realistic benchmarks.

Consultants and Advisors

Seeking the expertise of consultants and advisors can significantly enhance the quality and credibility of a business plan. Experienced consultants offer a wealth of knowledge and can provide in-depth insights into market trends, operational strategies, and financial forecasting, which may be beyond the current capacity of a new business owner.

Industry-specific advisors can guide entrepreneurs through nuances within their particular market and help to identify and assess potential challenges and opportunities. Meanwhile, business plan consultants can contribute their expertise to all aspects of the plan, ensuring a cohesive and comprehensive document. They are experienced in what potential investors look for and can advise on strategies to present the business in the best possible light.

It is important to vet potential consultants and advisors carefully. Credentials, past project portfolios, client testimonials, and specific experience related to the entrepreneur’s industry should be considered before engagement. Additionally, transparency with respect to their role, objectives, and the expectations for the business plan is vital to ensure alignment.

Hiring consultants and advisors can be costly, but it is an investment that can pay off by leading to a better-informed business strategy and increased likelihood of securing funding.

Educational Workshops and Seminars

These events can provide a platform for networking, interaction with industry experts, and direct learning about various aspects of business plan development.

These events often cover a wide array of topics including the fundamentals of entrepreneurship, market research methodologies, financial planning strategies, and tips for pitching to investors. Workshops can provide practical, hands-on training, often allowing attendees to work on their business plans with real-time feedback from workshop facilitators.

Local Small Business Development Centers (SBDCs), Chambers of Commerce, and organizations like AFFILIATE LINK host such events and may offer personalized guidance to attendees. These seminars often feature successful entrepreneurs and business professionals, sharing their experiences and offering practical advice.

To get the most benefit from attending these sessions, pick ones that are most relevant to your industry and business stage. And come prepared with specific questions and even a rough draft of a business plan to refine during the session.

Books and Online Resources

Books and online resources provide a wealth of knowledge for entrepreneurs at all stages of their business planning process. Accessible and sometimes free, they serve as a critical resource for independent learning and research.

Numerous publications, such as Start Your Own Business: The Only Startup Book You’ll Ever Need, offer comprehensive guidance on writing a business plan. Books like this often include sample business plans, checklists, and case studies that can be extremely helpful.

Online resources like Entrepreneur.com and the Small Business Administration (SBA) provide tools, templates, and articles that address every facet of business plan writing. Entrepreneurs can also find interactive tools and webinars that offer step-by-step guidance on the process.

Aside from the biggest mistake of all — not having a plan at all — there are some common missteps that can trip up entrepreneurs as they begin their journeys.

Grammatical errors: Frequent grammar mistakes can distract readers from the content of your business plan. Utilize grammar-checking tools and have a proficient editor go through the text.

Spelling mistakes: Incorrect spelling, especially of proprietary terms or industry-specific language, can undermine credibility.